Irs Schedule E Instructions 2024 1040 – The tables provide the tax rate, taxable income range, and tax calculation instructions tax you owe for 2023 (i.e., on the federal income tax return you file in 2024). Just make sure you . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 on the standard Form 1040. It includes sections for .

Irs Schedule E Instructions 2024 1040

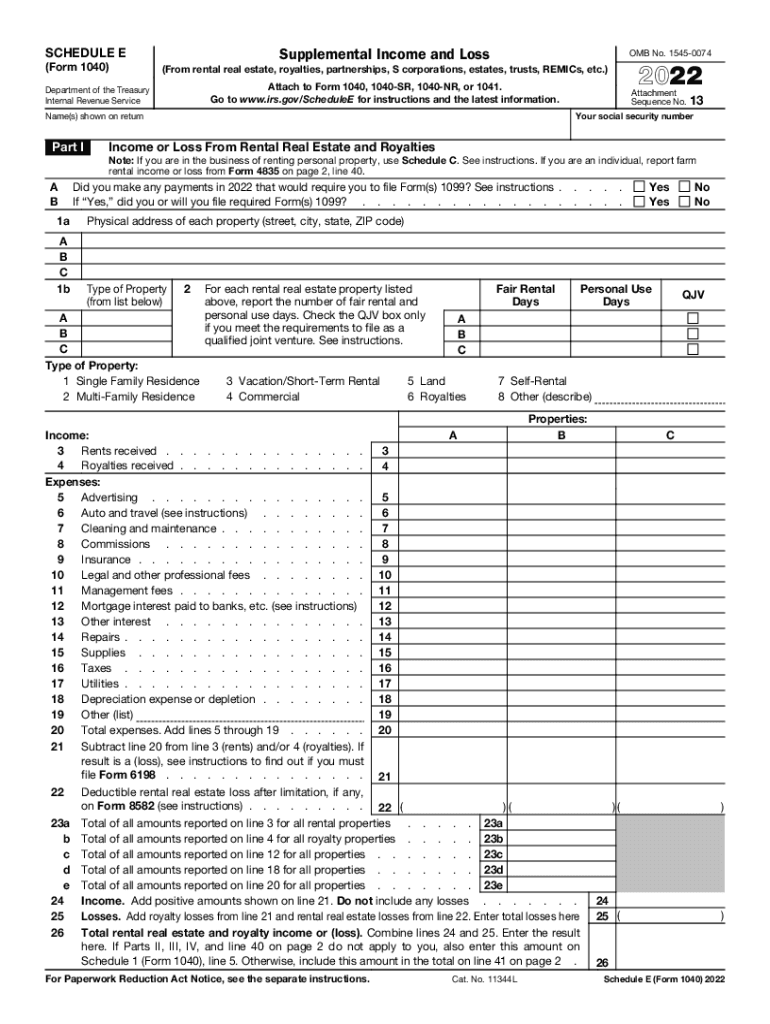

Source : www.irs.govSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.com1040 (2023) | Internal Revenue Service

Source : www.irs.govE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comTax form schedule e: Fill out & sign online | DocHub

Source : www.dochub.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comIrs Schedule E Instructions 2024 1040 1040 (2023) | Internal Revenue Service: This is reported on Schedule E for an individual’s tax return filed on Form 1040. An S corporation prepares For more on qualifying as an S-corp, see the instructions to Form 2553. . These limits are noted in the table below for both the 2023 and 2024 tax years above-the-line deductions, read the instructions for Form 1040 on the IRS website or consult your tax advisor. .

]]>