Gsa Mileage Rate 2024 Business Expenses – In 2024, the maximum amount federal workers could be reimbursed for miscellaneous relocation expenses akin to how GSA updates its reimbursement rates for per diem and travel mileage each . Covered business expenses typically include accommodation As mentioned previously, on Oct. 1 of every year new per diem rates are set by the GSA. For 2024 the standard lodging rate will .

Gsa Mileage Rate 2024 Business Expenses

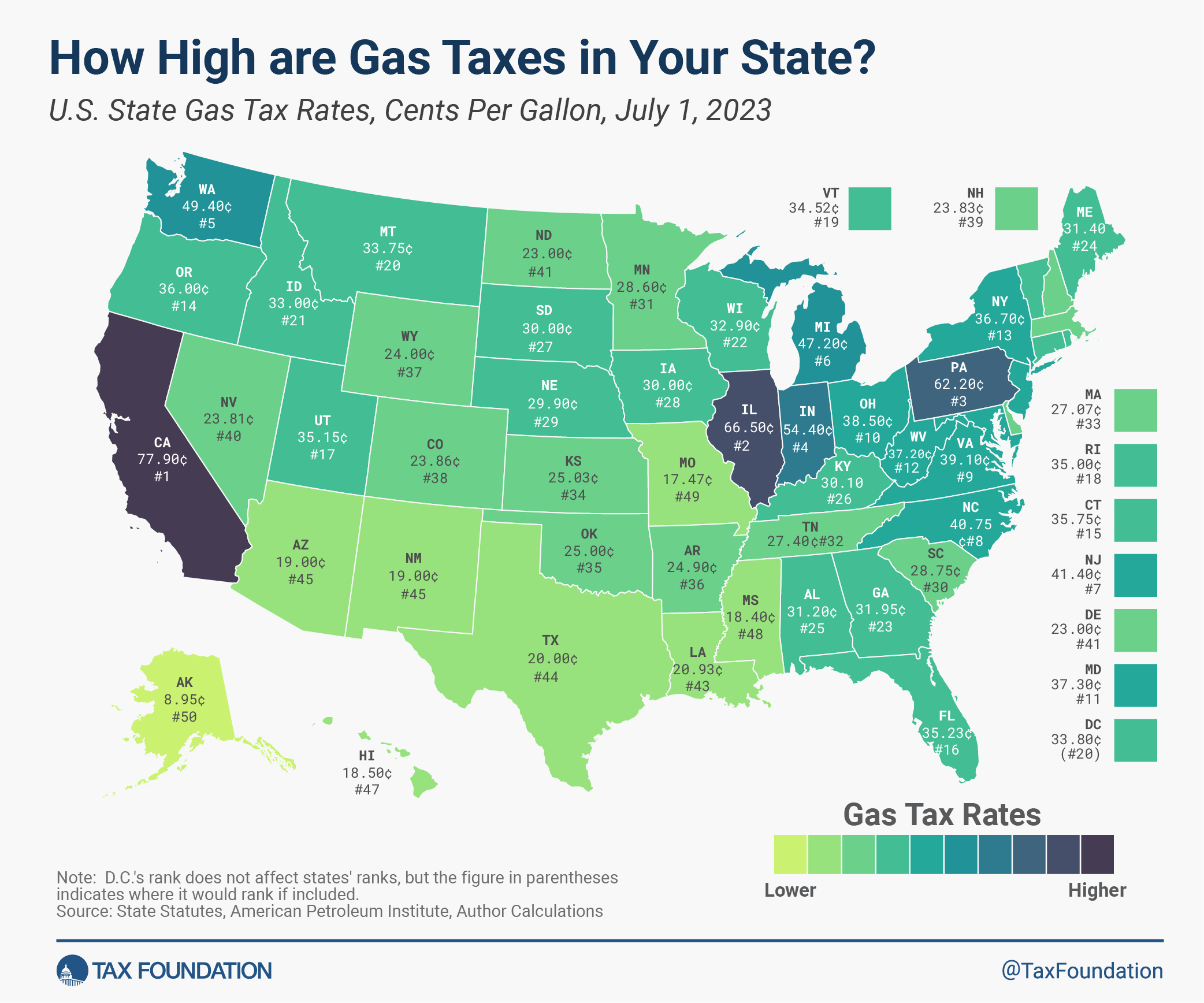

Source : www.forbes.com2023 State Gas Tax Rates | Gas Taxes by State | Tax Foundation

Source : taxfoundation.orgLopata, Flegel & Company LLP | St. Louis MO

Source : www.facebook.comIRS Mileage Rates: Deduct Miles Driven for Work on Your Taxes

Source : www.efile.comIRS Increases 2024 Mileage Reimbursement Rate to 67 Cents

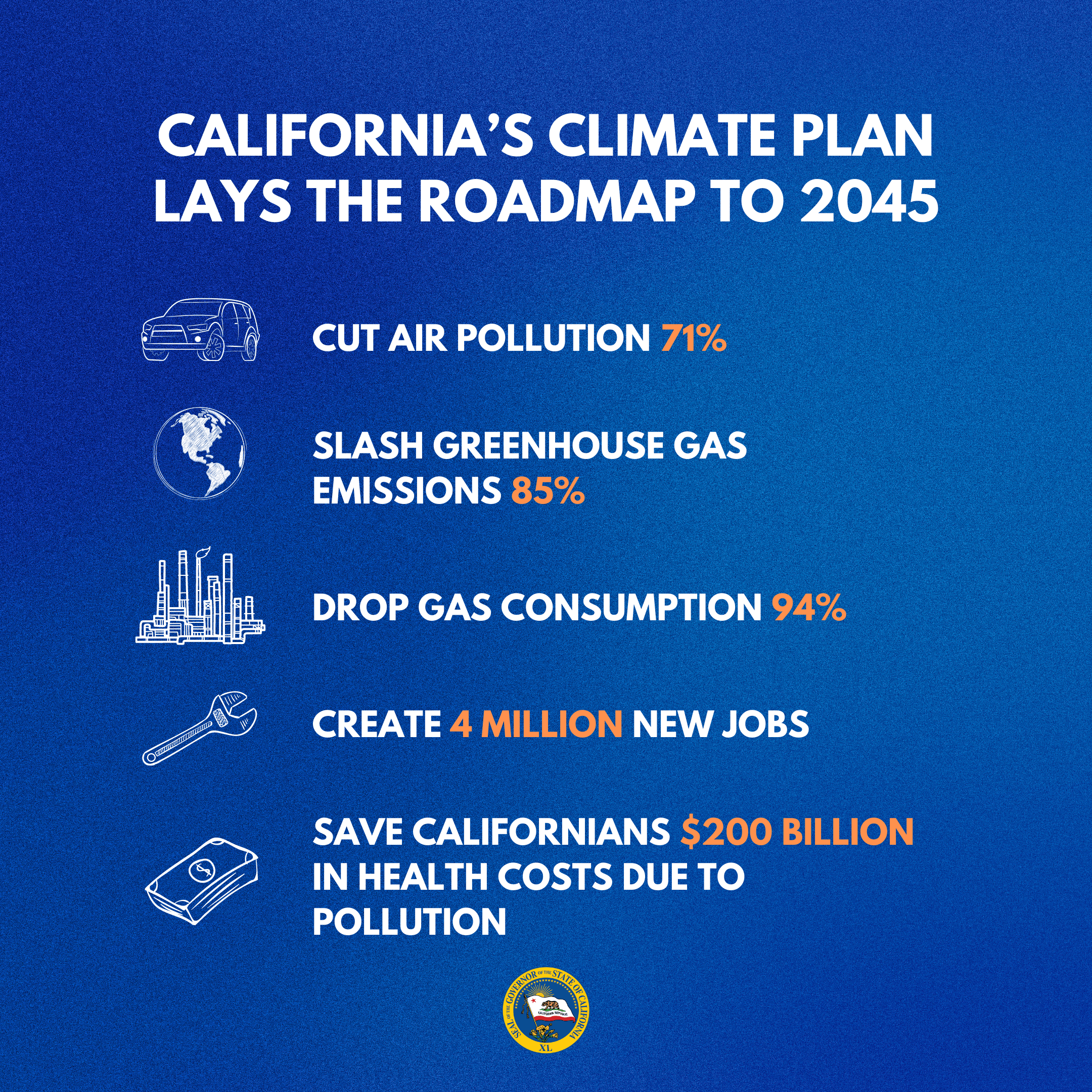

Source : www.montgomeryschoolsmd.orgCalifornia Releases World’s First Plan to Achieve Zero Carbon

Source : www.gov.ca.govHow To Claim Mileage on Taxes in Five Easy Steps

Source : www.driversnote.comThe Standard Business Mileage Rate Will Be Going Up Slightly In

Source : www.linkcpa.comThe standard business mileage rate will be going up slightly in

Source : awhitney.comFederal Acquisition Service Training overview | GSA

Source : www.gsa.govGsa Mileage Rate 2024 Business Expenses New 2023 IRS Standard Mileage Rates: Whether you’re an entrepreneur or a small business owner its ability to track mileage and tax rates for specific countries and regions. This means you can handle expenses easily, no matter . “Mileage allowance” is a term the Internal Revenue Service (IRS) uses to refer to the deductibility of expenses car owners accrue while operating a personal vehicle for business .

]]>