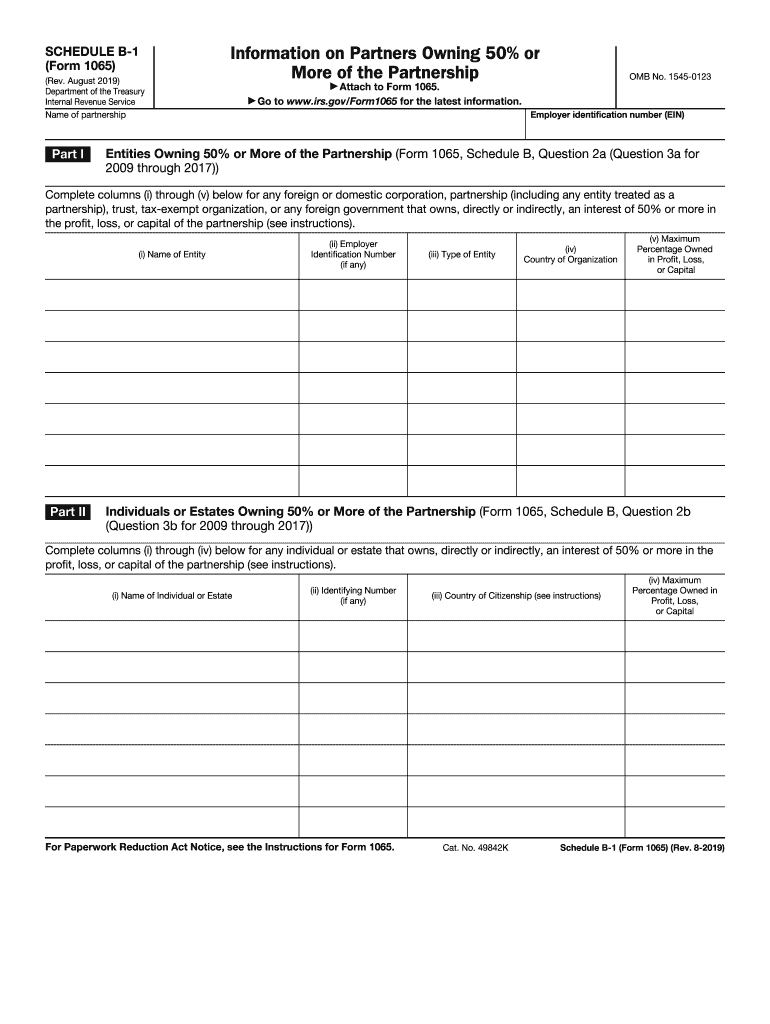

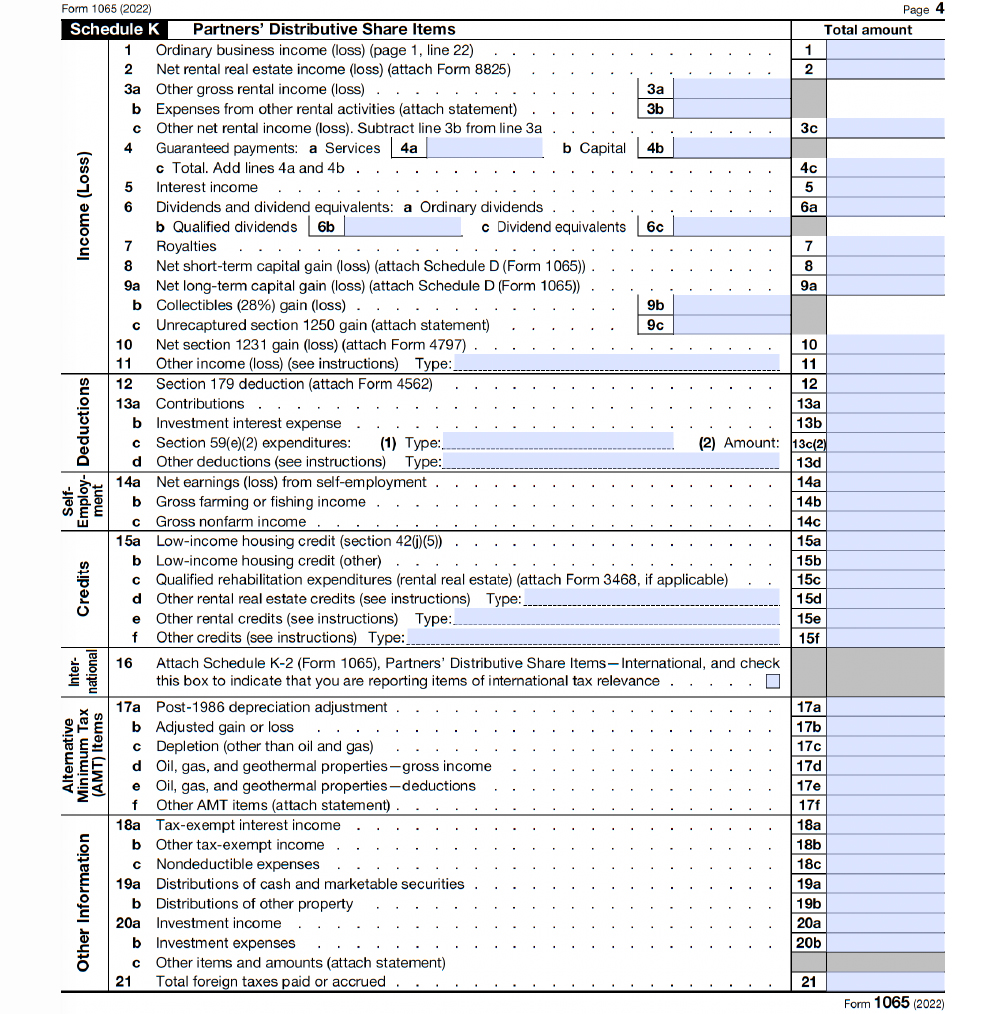

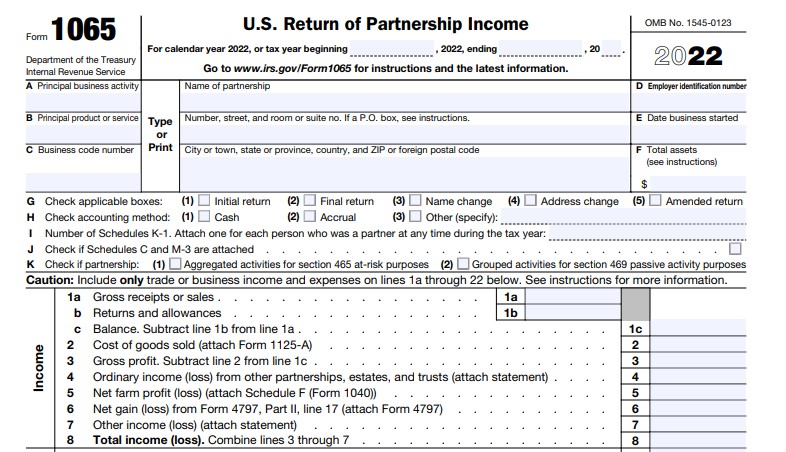

2024 Form Schedule 1065 – Partnerships generally don’t pay taxes and use Form 1065 to prepare Schedule K-1s (and Schedule K-3s, where appropriate) to pass-through income and losses to partners. • Partnerships must file . Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a .

2024 Form Schedule 1065

Source : form-1065-schedule-b-1.pdffiller.comForm 1065 Instructions: U.S. Return of Partnership Income

Source : lili.co2022 2024 Form IRS 1065 Schedule D Fill Online, Printable

Source : 1065-d.pdffiller.comForm 1065 Step by Step Instructions (+Free Checklist) for 2024

Source : fitsmallbusiness.comEasily Keep Track of 401(k) Compliance Dates

Source : www.shrm.org2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable

Source : schedule-k-1.pdffiller.comHope Financial Consulting on Instagram: “📆 Take out that brand

Source : www.instagram.comIRS 1065 Schedule B 1 2019 2024 Fill and Sign Printable

Source : www.uslegalforms.comOakley CPA PLLC | Nashville TN

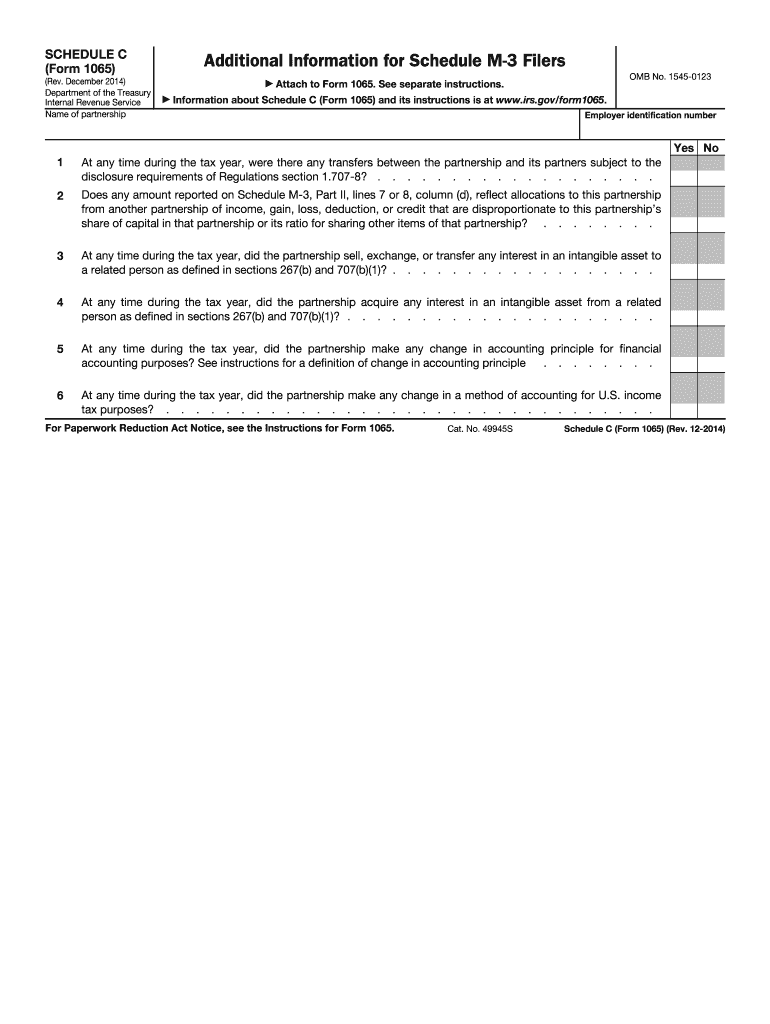

Source : www.facebook.com1065 schedule c: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form Schedule 1065 2019 2024 Form IRS 1065 Schedule B 1 Fill Online, Printable : While California is often synonymous with Hollywood glamour and beautiful coastlines, it’s also a hub for businesses across various industries. The state plays a vital role in America’s overall GDP. . If you own a small company, you may be considering structuring your business as a limited liability corporation or LLC. LLCs are seen as a favorable entity type by many business owners. The “limited .

]]>